Guide: How To Get VAT Number for Your Business in Nigeria

Have you ever looked at a receipt given to you after shopping at the supermarket and wondered why it’s marked as VAT inclusive? If you’ve never noticed that on your receipts, how about when you’ve concluded payments on a product and when you receive your invoice, there’s an extra amount tagged as VAT. As long as you’ve bought a good or service in Nigeria, you’ve paid your VAT. It is also your responsibility as a business owner to collect VAT in Nigeria from your customers and remit it to the federal government.

- What is VAT in Nigeria

- Steps to apply for a VAT number for your business

- When should you start paying VAT?

- When is the due date for VAT returns?

What is Value Added Tax (VAT) in Nigeria?

Value Added Tax (VAT) is a compulsory levy on the consumption of goods and services sold in Nigeria. In Nigeria, VAT is calculated as 7.5% of the cost of goods and services. The difference between VAT and other types of taxes expected from a business is that it is taxed on the consumer but the business owner is in charge of collecting and remitting it.

This means that if your product or service is sold at ₦10,000, the invoice you send to your customer must include a VAT of ₦750 leading to a sum of ₦10,750. Most business owners prefer to include it in the total price of goods instead of charging separately. However, it’s advised by the FIRS to charge VAT separately for transparency and easy returns.

Who is required to pay VAT in NIgeria?

All individuals and corporate bodies that engage in buying and selling goods and services are required to pay VAT. According to the Finance Act 2019 and the Value Added Tax Act, there are some goods and services exempt from VAT. They include:

- basic food items

- books and educational materials including educational performances and tuition from nursery to tertiary education

- all medical and pharmaceutical products

- baby products

- all exported goods and services

- imported machines for use in the Export Processing Zone (EPZ) or free trade zone

- fertiliser and locally made agricultural medicines and agricultural equipment

- life insurance

- transportation services for public use

- lease on residential property

- equipment for utilisation of gas in down-stream petroleum operations

- microfinance banks people’s bank and mortgage institutions services

- locally manufactured sanitary towels

To learn more about the exempt goods and services, please read this Mazars Insights

Steps to apply for VAT Number for Your Business

Before applying for a VAT number for your business, ensure that you have a Tax Identification Number (TIN) for your business. To register your business for VAT in Nigeria is free. All you need to do is go to the nearest FIRS office or your State Internal Revenue Service. Here are the documents you need to apply for a VAT number for registered business names and limited liability companies.

For Incorporated companies

- Memorandum and articles of association

- Certificate of Incorporation

- Download and fill the VAT Form 001 (Download here)

- Utility bill

- Application letter on your company’s letterheaded paper

For registered business names

- Business Name Registration Certificate

- Utility bill

- VAT form 001

- Application Letter on your business’ letterheaded paper

Note: Please ensure that you go with the originals and 2 photocopies of each document.

Frequently Asked Questions on VAT in Nigeria

When should I start paying tax in Nigeria?

Every business must register for VAT with the FIRS within 6 months of commencement of business in accordance with Section 8 of the Value Added Tax Act.

How do you calculate VAT in Nigeria?

The old VAT rate in Nigeria was 5%. However, on February 1, 2020, the Value Added Tax act was amended and the VAT rate is now calculated at 7.5%

When is the due date for VAT Returns?

VAT returns are to be filed on the 21st of every month.

Do you have any questions on remitting VAT in Nigeria as a business owner? Share in the comments and we’ll respond to you.

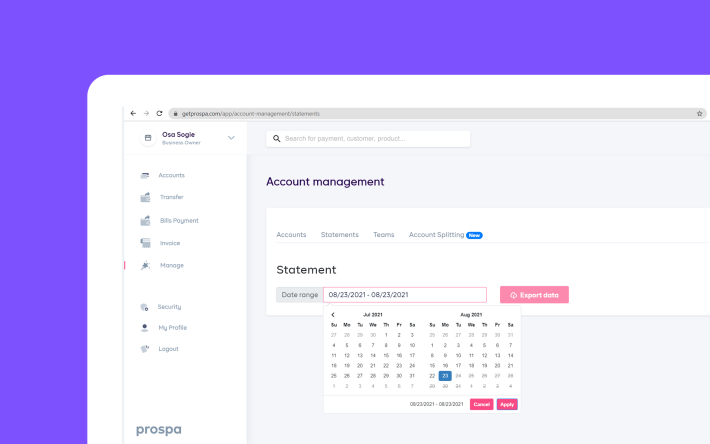

Prospa is an app for entrepreneurs to manage their business finances. You can create VAT inclusive invoices and automate tax deductions to remain compliant in your business. Download Prospa to get started.